THE PROBLEM OF THE RUPEE:

ITS

ORIGIN AND ITS SOLUTION

(HISTORY OF INDIAN CURRENCY & BANKING)

_________________________________________________________________________________________________

CHAPTER III Continued---

TABLE XVIII

development oF jute

industry aND trade

Growth |

|||||

|

1870-71 to 1874-75 |

1875-76 to 1879-80 |

1880-81 to 1884-85 |

1885-86 to 1889-90 |

1890-91 to 1894-95 |

Exports— |

|

|

|

|

|

Raw, million cwt. |

5.72 |

5.58 |

7.81 |

9.31 |

10.54 |

Gunny bags, millions |

6.44 |

35.96 |

60.32 |

79.98 |

120.74 |

Cloth, million yds. |

|

4.71 |

6.44 |

19.79 |

54.20 |

Growth of Industry |

|

|

|

|

|

Number of— |

|

|

|

|

|

Mills |

|

21 |

21 |

24 |

26 |

Looms, 000 omitted |

|

5.5 |

5.5 |

7 |

8.3 |

Spindles, 000 omitted |

|

88 |

88 |

138.4 |

172.4 |

Persons employed, in

thousands |

|

38.8 |

38.8 |

52.7 |

64.3 |

The chief cause was said to be the inability of the English

manufacturers to hold out in international competition. This inability to compete with the

European rivals was attributed to the prevalence of protective tariffs and subsidies which

formed an essential part of the industrial and commercial code of the European countries.

TABLE XIX

growth oF agricultural

exports oF india

|

1868-69 |

1873-74 |

1877-78 |

1882-83 |

1887-88 |

1891-92 |

Wheat |

100 |

637.41 |

2,313.47 |

5,152.36 |

4,914.37 |

11,001.44 |

Opium |

100 |

118.38 |

123.83 |

122.47 |

120.20 |

116.82 |

Seeds |

100 |

111.26 |

305.87 |

239.97 |

403.60 |

480.99 |

Rice |

100 |

131.66 |

119.84 |

203.28 |

185.55 |

220.36 |

Indigo |

100 |

116.91 |

121.57 |

142.17 |

140.76 |

126.33 |

Tea |

100 |

169.35 |

293.17 |

507.25 |

775.09 |

1,075.75 |

100 |

86.04 |

69.98 |

85.31 |

64.59 |

74.11 |

Nothing of the kind then

existed in India, where trade was as free and industry as unprotected as any could have

been, and yet the Lancashire cotton-spinner, the Dundee jute manufacturer and the English

wheat-grower complained that they could not compete with their rivals in India. The cause,

in this case, was supposed to be the falling exchange.[f1] So much were some people impressed by

this view that even the extension of the Indian trade to the Far East was attributed to

this cause. Already, it was alleged, the dislocation of the par of exchange between gold

and silver had produced a kind of segregation of gold-using countries and silver-using

countries to the exclusion of each other. In a transaction between two countries using the

same metal as standard it was said the element of uncertainty arising from the use of two

metals varying in terms of each other was eliminated. Trade between two such countries

could be carried on with less risk and less inconvenience than between two countries using

different standards, as in the latter case the uncertainty entered into every transaction

and added to the expense of the machinery by which trade was carried on. That the Indian

trade should have been deflected to other quarters[f2]where, owing to the

existence of a common standard the situation trade had to deal with was immune from

uncertainties, was readily admitted. But it was contended that there was no reason why, as

a part of the segregation of commerce, it should have been possible for the Indian

manufacturer to oust his English rival from the Eastern markets to the extent he was able

to do (see Table XX, p. 432).

The causes which effected such trade

disturbances formed the subject of a heated controversy. [f3] The point in dispute was whether the changes

in international trade, such as they were, were attributable to the monetary disturbances

of the time. Those who held to the affirmative explained their position by arguing that

the falling exchange gave a bounty to the Indian producer and imposed a penalty on the

English producer.

TABLE XX

exports of cotton

goods to eastern markets

Years |

Yarn, Ibs., 000 omitted |

Piece-goods, yds., 000 omitted |

||

|

From India |

From U. K. |

From India |

From U. K. |

1877 |

7,927 |

33,086 |

15,544 |

394,489 |

1878 |

15,600 |

36,467 |

17,545 |

382,330 |

1879 |

21,332 |

38,951 |

22,517 |

523,921 |

1880 |

25,862 |

46,426 |

25,800 |

509,099 |

1881 |

26,901 |

47,479 |

30,424 |

587,177 |

1882 |

30,786 |

34,370 |

29,911 |

454,948 |

1883 |

45,378 |

33,499 |

41,534 |

415,956 |

1884 |

49,877 |

38,856 |

55,565 |

439,937 |

1885 |

65,897 |

33,061 |

47,909 |

562,339 |

1886 |

78,242 |

26,924 |

51,578 |

490,451 |

1887 |

91,804 |

35,354 |

53,406 |

618,146 |

1888 |

113,451 |

44,643 |

69,486 |

652,404 |

1889 |

128,907 |

35,720 |

70,265 |

557,004 |

1890 |

141,950 |

37,869 |

59,496 |

633,606 |

1891 |

169,253 |

27,971 |

67,666 |

595,258 |

distribution oF INDIAN trade

Annual Average for each Quinquennium in

Millions of rupees

|

1875-76 to 1879-80 |

1880-81 to 1884-85 |

||||

Countries |

|

|

|

|

|

|

|

Imports |

Exports |

Total |

Imports |

Exports |

Total |

United Kingdom |

323.68 |

278.15 |

601.83 |

434.45 |

344.22 |

778.67 |

China |

14.05 |

132.27 |

146.32 |

19.23 |

134.94 |

154.17 |

Japan |

.02 |

.33 |

.35 |

.19 |

2.09 |

2.28 |

Ceylon |

5.74 |

22.97 |

28.71 |

5.35 |

16.37 |

21.72 |

Straits Settlement |

10.83 |

26.11 |

36.94 |

15.88 |

33.65 |

49.53 |

Annual Average for each Quinquennium in

Millions of rupees

|

1885-86 to 1989-90 |

1890-91 to 1894-95 |

||||

Countries |

|

|

|

|

|

|

|

Imports |

Exports |

Total |

Imports |

Exports |

Total |

United Kingdom |

510.47 |

360.59 |

871.06 |

526.24 |

338.40 |

864.64 |

China |

21.64 |

134.54 |

156.18 |

28.69 |

133.30 |

161.90 |

Japan |

.25 |

7.27 |

7.52 |

1.51 |

14.44 |

15.95 |

Ceylon |

5.86 |

20.56 |

26.42 |

6.42 |

31.18 |

37.60 |

Straits Settlement |

20.09 |

42.54 |

62.63 |

23.32 |

52.56 |

75.88 |

The existence of this bounty, which was said to

be responsible for the shifting of the position of established competitors in the field of

international commerce, was based on a simple calculation. It was said that if the gold

value of silver fell the Indian exporter got more rupees for his produce and was therefore

better off, while by reason of the same fact the English producer got fewer sovereigns and

was therefore worse off. Put in this naive form, the argument that the falling exchange

gave a bounty to the Indian exporters and imposed a penalty on the English exporters had

all the finality of a rule of arithmetic. Indeed, so axiomatic was the formula regarded by

its authors that some important inferences as to its bearing on the trade and industrial

situation of the time were drawn from it. One such inference was that it stimulated

exports from and hindered imports into the silver-using

countries. The second inference was that the fall of exchange exposed some English

producers more than others to competition from their rivals in silver-using countries. Now, can such results be said to follow from

the fall of exchange ? If we go behind the bald statement

of a fall of exchange and inquire as to what determined the gold price of silver the above

inferences appear quite untenable. That the ratio between gold and silver was simply the

inverse of the ratio between gold prices and silver prices must be taken to be an

unquestionable proposition. If therefore the gold price of silver

was falling it was a counterpart of the more general phenomenon of the fall of the English

prices which were measured in gold, and the rise of the Indian prices which were measured

in silver. Given such an interpretation of the event of the falling exchange, it is

difficult to understand how it can help to increase exports and diminish imports.

International trade is governed by the relative advantages which one country has over

another, and the terms on which it is carried on are regulated by the comparative cost of

articles that enter into it. It is, therefore, obvious that there cannot be a change in

the real terms of trade between countries except as a result of changes in the comparative

cost of these goods. Given a fall in gold prices all

round, accompanied by a rise in silver prices all

round, there was hardly anything in the monetary disturbance that could be said to

have enabled India to increase her exportation of anything except by diminishing her

exportation or increasing her importation of something else. From the same view of the

question of the falling exchange it follows that such a monetary disturbance could not

depress one trade more than another. If the falling or rising exchange was simply an

expression of the level of general prices, then

the producers of all articles were equally affected. There was no reason why the cotton

trade or the wheat trade should have been more affected by the fall of exchange than the

cutlery trade.

Not only was there nothing in the exchange

disturbance to disestablish existing trade relations in general or in respect of

particular commodities, but there was nothing in it to cause benefit to the Indian

producer and injury to the English producer. Given the fact that the exchange was a ratio

of the two price-levels, it is difficult to see in what sense the English producer, who

got fewer sovereigns but of high purchasing power, was worse off than the Indian producer,

who got more rupees but of low purchasing power. The analogy of Prof. Marshall was very

apt. To suppose that a fall of exchange resulted in a loss to the former and a gain to the

latter was to suppose that, if a man was in the cabin of a ship only ten feet high, his

head would be broken if the ship sank down twelve feet into a trough. The fallacy

consisted in isolating the man from the ship when, as a matter of fact, the same force,

acting upon the ship and the passenger at one and the same time, produced like movements

in both. In like manner, the same force acted upon the Indian producer and the English

producer together, for the change in the exchange was itself a part of the more sweeping

change in the general price-levels of the two countries. Thus stated, the position of the

English and Indian producer was equally good or equally bad, and the only difference was

that the former used fewer counters and the latter a larger number in their respective

dealings.

A bounty to the Indian producer and a penalty

to the English producer, it is obvious, could have arisen only if the fall of silver in

England in terms of gold was greater than the fall of silver in terms of commodities in

India. In that case the Indian producer would have obtained a clear benefit by exchanging

his wares for silver in England and thus securing a medium which had a greater command

over goods and services in India. But a priori there

could be no justification for such an assumption. There was no reason why gold price of

silver should have fallen at a different rate from the gold price of commodities in

general, or that there should have been a great difference between the silver prices in

England and in India. Statistics show that such a

priori assumptions were not groundless. (See Table XXI).

TABLE

XXI. movements oF prices, wages aND silver BETWEEN india

aND england [f4]

Years. |

Index No. for Wages In India. |

Index No. for Gold Prices of Commodities in England. |

Index No. for Wages In England. |

||||

Years. |

Amount. Rs. |

|

|

|

|

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

1871-72 |

6,587,296 |

99.7 |

1871 |

100 |

|

100 |

100 |

1872-73 |

739,244 |

99.2 |

1872 |

105 |

— |

109 |

105.8 |

1873-74 |

2,530,824 |

97.4 |

1873 |

107 |

100 |

III |

112 |

1874-75 |

4,674,791 |

95.8 |

1874 |

116 |

101 |

102 |

113 |

1875-76 |

1,640,445 |

93.3 |

1875 |

103 |

97 |

96 |

111.6 |

1876-77 |

7,286,188 |

86.4 |

1876 |

107 |

98 |

95 |

110 |

1877-78 |

14,732,194 |

90.2 |

1877 |

138 |

97 |

94 |

109.8 |

1878-79 |

4,057,377 |

86.4 |

1878 |

148 |

99 |

87 |

107 |

1879-80 |

7,976,063 |

84.2 |

1879 |

135 |

100 |

83 |

105.8 |

1880-81 |

3,923,612 |

85.9 |

1880 |

117 |

99 |

88 |

106.5 |

1881-82 |

5,381,410 |

85.0 |

1881 |

106 |

99 |

85 |

106.5 |

1882-83 |

7,541,427 |

84.9 |

1882 |

105 |

100 |

84 |

106.5 |

1883-84 |

6,433,886 |

83.1 |

1883 |

106 |

102 |

82 |

108 |

1884-85 |

7,319,581 |

83.3 |

1884 |

114 |

101 |

76 |

109 |

1885-86 |

11,627,028 |

79.9 |

1885 |

113 |

106 |

72 |

108 |

1886-87 |

7,191,743 |

74.6 |

1886 |

110 |

105 |

69 |

107 |

1887-88 |

9,319,421 |

73.3 |

1887 |

III |

114 |

68 |

108 |

1888-89 |

9,327,529 |

70.4 |

1888 |

119 |

112 |

70 |

109.8 |

1889-90 |

11,002,078 |

70.2 |

1889 |

125 |

112 |

72 |

113 |

1890-91 |

14,211,408 |

78.4 |

1890 |

125 |

113 |

72 |

118 |

1891-92 |

9,165,684 |

74.3 |

1891 |

128 |

118 |

72 |

118 |

1892-93 |

12,893,499 |

65.5 |

1892 |

141 |

110 |

68 |

117.4 |

1893-94 |

13.759,273 |

58.5 |

1893 |

138 |

119 |

68 |

117.4 |

It is obvious that if silver was falling faster

than commodities, and if silver prices in India were lower than silver prices in England,

we should have found it evidenced by an inflow of silver from England to India. What were

the facts ? Not only was there no extraordinary flow of

silver to India, but the imports of silver during 1871-93 were much smaller than in the

twenty years previous to that period.[f5] This is as complete a demonstration as could

be had of the fact that the silver prices in India were the same as they were outside, and

consequently the Indian producer had very little chance of a bounty on his trade.

Although such must be said to be the a priori view of the question, the Indian producer

was convinced that his prosperity was due to the bounty he received. Holding such a

position he was naturally opposed to any reform of the Indian currency, for the falling

exchange which the Government regarded a curse he considered a boon. But however plausible

was the view of the Indian producer, much sympathy would not have been felt for it had it

not been coupled with a notion, most commonly held, that the bounty arose from the export trade, so that it became an article of

popular faith that the fall of exchange was a source of gain to the nation as a whole.

Now was it true that the bounty arose from the export trade ?

If it were so, then every fall of exchange ought to give a bounty. But supposing that the

depreciation of silver had taken place in India before

it had taken place in Europe could the fall of exchange thus brought about have given a

bounty to the Indian exporter ? As was explained above, the

Indian exporter stood a chance of getting a bounty only if with the silver he obtained for

his produce he was able to buy more goods and services in India. To put the same in

simpler language, his bounty was the difference between the price of his product and the

price of his outlay. Bearing this in mind, we can confidently assert that in the supposed

case of depreciation of silver having taken place in India first, such a fall in the

Indian exchange would have been accompanied by a penalty instead of a bounty on his trade.

In that case, the exporter from India would have found that though the Indian exchange,

i.e. the gold price of silver, had fallen, yet the ratio which gold prices in England bore

to silver prices in India had fallen more, i.e. the price he received for his product was

smaller than the outlay he had incurred. It is not quite established whether silver had

fallen in Europe before it had fallen in India.*[f6] But even if that were so the possibility of a

penalty through the fall of exchange proves that the bounty, it there was any, was not a

bounty on the export trade as such, but was an outcome of the disharmony between the

general level of prices and the prices of particular goods and services within the

country, and would have existed even if the

country had no export trade.

Thus the bounty was but an incident of the

general depreciation of the currency. Its existence was felt because prices of all goods and services in India did not move in the

same uniform manner. It is well known that at any one time

prices of certain

commodities will be rising, while the general price level is falling. On the other hand,

certain goods will decline in price at the same time that the general price-level is

rising. But such opposite movements are rare. What most often happens is that prices of

some goods and services, though they move in the same direction, do not move at the same

pace as the general price level. It is notorious that

when general prices fall wages and other fixed incomes, which form the largest item in the

total outlay of every employer, do not fall in the same

proportion; and when general prices rise they do not rise as fast as general prices, but

generally lag behind. And this was just what was happening in a silver-standard country

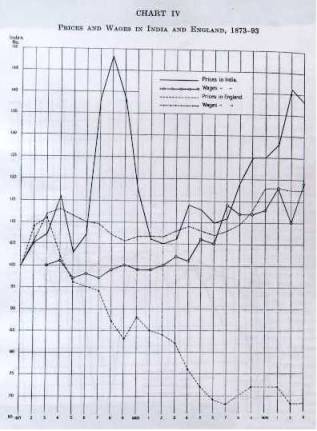

like India and a gold-standard country like England during the period of 1873-93 (see Chart IV).

CHART IV

prices aND wages

IN india aND england, 1873-93

Prices had fallen in England, but wages had not

fallen to the same extent. Prices had risen in India, but wages had not risen to the same

extent. The English manufacturer was penalised, if at all, not by any act on the part of

his Indian rival, but by reason of the wages of the former's employees having remained the

same, although the price of his products had fallen. The Indian producer got a bounty, if

any, not because he had an English rival to feed upon, but because he did not have to pay

higher wages, although the price of his product had risen.

The conclusion,

therefore, is that the failing exchange could not have

disturbed established trade relations

or displaced the commodities

that entered into international trade. The utmost that could be attributed to it is its

incidence in economic incentive. But in so far as it supplied a motive force or took away

the incentive, it did so by bringing about changes in the social distribution of wealth.

In the case of England, where prices were falling, it was the employer who suffered ; in the case of India, where prices were rising, it was the

wage-earner who suffered. In both cases there was an injustice done to a part of the

community and an easy case for the reform of currency was made out. The need for a

currency reform was recognised in England ; but in India many people seemed averse to it.

To some the stability of the silver standard had made a powerful appeal, for they failed

to find any evidence of Indian prices having risen above the level of 1873. To others the

bounty of the falling exchange was too great a boon to be easily given away by stabilising

the exchange. The falsity of both the views is patent. Prices in India did rise and that,

too, considerably. Bounty perhaps there was, but it was a penalty on the wage-earner. Thus

viewed, the need for the reform of Indian currency was far more urgent than could have

been said of the English currency. From a purely psychological point of view there is

probably much to choose between rising prices and falling prices. But from the point of

view of their incidence on the distribution of wealth, very little can be said in favour

of a standard which changes in its value and which becomes the via media of transferring wealth from the

relatively poor to the relatively rich. Scope said: "Without stability of value money

is a fraud." Surely, having regard to the magnitude of the interests affected,

depreciated money must be regarded as a greater fraud. That being so, the prosperity of

Indian trade and industry, far from being evidence of a sound currency, was sustained by

reason of the fact that the currency was a diseased currency. The fall of exchange, in so

far as it was a gain, registered a loss to a large section of the Indian people with fixed

incomes who suffered from the instability of the silver standard equally with the

Government and its European officers.

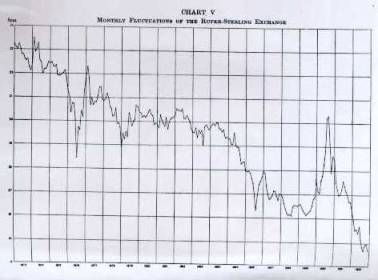

So much for the fall of silver. But the

financial difficulties and social injustices it caused did not sum up the evil effects

produced by it. Far more disturbing than the fall were the fluctuations which accompanied

the fall (see Chart V).

CHART

V

monthly

fluctuations oF THE rupee-stehlinG exchange

The fluctuations greatly aggravated the

embarrassment of the Government of India caused by the fall in the exchange value of the

rupee. In the opinion of the Hon. Mr. Baring (afterwards Lord Cromer),

[f7]

" It is not

the fact that the value of the rupee is, comparatively speaking, low that causes

inconvenience. It would be possible, although it might be exceedingly troublesome, to

adjust the Indian fiscal system to a rupee of any value. What causes inconvenience alike

to Government and to trade is that the value of the rupee is unstable. It is

impossible to state accurately in Indian currency what the annual liabilities of the

Government of India are. These liabilities have to be calculated afresh every year

according to the variations which take place in the relative value of gold and silver, and a

calculation which will hold good for even one year is

exceedingly difficult to make."

Owing

to such fluctuations, no rate could be assumed in the Budget which

was likely to turn out to be the true market rate. As matters stood, the rate realised on

an average during a particular year differed so widely from the Budget rate that the finances of the Government became,

to employ the phraseology of a finance minister, a "veritable

gamble." How greatly the annual Budget must have been deranged by the sudden

and unprovided

for changes in the rupee cost of the sterling payments Table XXII on page 442 may help to give some idea.

If Government finance was

subjected to such uncertainties as a result of exchange fluctuations, private trade also

became more or less a matter of speculation. Fluctuations in exchange are, of course, a

common incident of international trade. But if they are not to produce discontinuity in

trade and industry there must be definite limits to such fluctuations. If the limits are ascertainable, trade would be reasonably certain in its

calculation, and speculation in exchange would be limited within the known limits of

deviations from an established par. Where, on the other hand, the limits are unknown, all

calculations of trade are frustrated and speculation in exchange takes the place of

legitimate trading. Now, it is obvious that fluctuations in the

exchange between two countries will be limited in extent if the two countries have the

same standard of value.

fluctuations of exchange and fluctuations IN THE rupee cost of gold

payments[f8]

Financial Year. |

Estimated

Rate of Ex-change on which the Budget of the Year was framed. |

Rate of Exchange actually realised on

the Average during the Year. |

Changes

in the Rupee Cost of Sterling Payments consequent upon Changes between

the Estimated and the Realised Rates of Exchange. |

|

|

|

|

Increase. |

Decrease. |

|

s.

d. |

Rs. |

||

1874-75 |

1

10.375 |

1

10-156 |

15,91,764 |

— |

1875-76 |

1

9.875 |

1

9-626 |

19,57,917 |

— |

1876-77 |

1

8.5 |

1

8-508 |

— |

76,736 |

1877-78 |

1

9.23 |

1

8-791 |

38,43,050 |

— |

1878-79 |

1

8.4 |

1

7-794 |

56,87,129 |

— |

1879-80 |

1

7 |

1

7-961 |

— |

84,40,737 |

1880-81 |

1

8 |

1

7-956 |

4,24,722 |

— |

1881-82 |

1

8 |

1

7-895 |

10,17,482 |

— |

1882-83 |

1

8 |

1

7-525 |

37,46,890 |

— |

1883-84 |

1

7.5 |

1

7-536 |

— |

3,62,902 |

1884-85 |

1

7.5 |

1

7-308 |

18,97,307 |

— |

1885-86 |

1

7 |

1

6-254 |

56,82,638 |

— |

1886-87 |

1

6 |

1

5-441 |

65,17,721 |

— |

1887-88 |

1

5.5 |

1

4-898 |

71,90,097 |

— |

1888-89 |

1

4.9 |

1

4-379 |

77,98,400 |

— |

1889-90 |

1

4.38 |

1

4-566 |

— |

27,31,892 |

1890-91 |

1

4.552 |

1

6-09 |

— |

2,35,51,744 |

1891-92 |

1

5.25 |

1

4-733 |

80,09,366 |

— |

Where there is no such common

standard of value the limits, though they exist,

are too indefinite to be of much practical use.

The rupture of the fixed par of exchange, having destroyed a common standard of value

between gold and silver countries, removed the limits on the exchange fluctuations between

such countries. As a result of such variations in the value of the standard measure, trade

advanced by " rushes and pauses," and

speculation became feverishly active[f9]

That

progress of trade depends on stability is a truism which seldom comes home until it is

denied in fact. It is difficult to appreciate its importance to healthy enterprise when

government is stable, credit is secure, and conditions are uniform. And yet so great is the handicap of instability that everywhere businessmen have been led by a variety of devices to produce stability in domains enveloped by

uncertainty. Everywhere there have grown up business barometers forewarning business men of

impending changes and so enabling them to forearm against them by timely changes in their

operations. The whole of insurance business is aimed at giving stability to economic life.

The necessity which compelled all regularly established Governments to maintain standard

measures by which the true proportion between things as to their quantities might be

ascertained and dealings in them regulated with certainty was motivated by the same

purpose. The meticulous precision with which every civilised country defines its standard

measures, and the large machinery it maintains to preserve them from deviation, are only

evidences of the great importance that an economic society must continue to attach to the

matter of providing precision of expression and assurance of fulfilment with regard to the

contracts entered into by its members in their individual or corporate capacities.

Important

as are the standard measures of a community, its measures of a community, its measure of

value is by far the most important of them all.[f10] The measures of weight, extension, or volume

enter only into particular transactions. If the pound, the bushel, or the yard were

altered the evils would be comparatively restricted in scope. But the measure of value is all-pervading.

"There

is no contract," Peel declared.[f11] "public or private, no engagement

national or individual, which is unaffected by it. The enterprises of commerce, the

profits of trade, the arrangements made in all domestic relations of society, the wages,

of labour, pecuniary transactions of the highest amount and of the lowest, the payment of

national debt, the provision for national expenditure, the command which the coin of the

smallest denomination has over the necessaries of life, are all affected "

by

changes in the measure of value. This is because every contract, though ultimately a

contract in goods, is primarily a contract in value. It is, therefore, not enough to

maintain constancy in the measures of weight, capacity, or volume. A contract as one of

goods may remain exact to the measure stipulated, but may nevertheless be vitiated as a

contract in values by reason of changes in the measure of values. The necessity of

preserving stability in its measure of value falls on the shoulders of every Government of

an orderly society. But its importance grows beyond disputes as society advances from

status to contract. The conservation of the contractual basis of society then becomes

tantamount to the conservation of an invariable measure of value.

The

work of reconstituting a common measure of value in some form or other, which those

misguided legislators of the seventies helped to destroy, it was found, could not be long

delayed with impunity. The consequences that followed in the wake of that legislation, as

recounted before, were too severe to allow the situation to remain unrectified. That

efforts for reconstruction should have been launched before much mischief was done only

shows that a world linked by ties of trade will insist, if it can, that its currency

systems must be laid on a common gauge.